Studio Vannucci & Associati

Do you want to make a true, reliable valuation of your business idea? We describe here the principle methods that are used.

The process of business valuation is a very complex operation that, through a series of logical stages, allows us to determine the value of a business at a given moment. This procedure is of fundamental importance, especially for startups. Giving a monetary value to a project that is in its early stages of development is an essential pathway for all business owners who want to negotiate a price with Equity investors or financiers.

Adopt a prudent approach

The process of business valuation, however, is especially difficult for businesses that are new startups because of greater elements of uncertainty compared to the worth of the businesses that are already mature or operating on the market; these businesses are totally lacking in historical data such as balance sheets or other accounting information and the only document on the basis of which a valuation can be made is the business plan. The evaluation itself has, therefore, an aspect of uncertainty because it is founded on hypotheses deduced from predictions about the future development of the project, which could prove to be overly optimistic.

Beginning with these premises, the valuation process should always move following a prudential approach, keeping in mind that the data on which to base the hypotheses come from a business plan that is strongly influenced by the subjectivity of the entrepreneur.

Therefore, it is necessary on the one hand to use valuation methods that can grasp the uncertainty that accompanies projects during the startup phase, and on the other hand to apply correctives to the methods used most often in valuing mature businesses.

With this aim, we will describe below the three methods that in our opinion are most often adapted by businesses in the startup phase:

I. discounted cash flow method

II. venture capital method

III. First Chicago method

I. Discounted cash flow method

The discounted cash flow method (DCF) is based on the rule of present value, where the value of any activity is given by the discounting of cash flows that these activities can presumably generate in the future.

The classic variant of this method calls for the use of two different discount rates in terms of the flows that will then be updated:

– weighted average cost of capital (WACC), for discounting of gross flows;

– Cost of capital (Ke), for discounting of net flows.

In the case of a startup, generally the expected rate of return on investment is used as the discount rate for discounting the flows. Generally, free cash flow from operations or free cash flow to equity are used, or alternatively the gross operating margin (Ebitda), approximating the cash flow available for investors, can be used.

These dimensions, which as we have said for startups are elaborations deriving from the business plan, can be adjusted as necessary with a weighting coefficient that takes into consideration the uncertainty of the calculated flows. In particular, major weight can be attributed to flows that are nearer to time 0, since they are more probable, while given decreasing weight to flows as they move farther away from the time at which the valuation is carried out. The most frequently used DCF variant is the so-called “two-stage” variant, in which the value of the business is given by two components:

– a component that considers the value of the business in the period of analytic forecasting, generally from year 0 to year 5;

– a component that considers the estimated value of the business at the end of the analytic forecasts, or from year 5 onward.

The first component is determined by the summation of the cash flows, updated during the period of analytic forecasts. This period represents the number of years for which the estimate of future flows is carried out and, precisely because of the uncertainty inherent in the estimate, it can rarely exceed 5 years. So the first step is the estimate of future cash flows and their consequent adjustment to a pre-established discount rate.

The second component is represented by discounting the terminal value. The terminal value synthesizes the value of the business at the end of the analytic forecasts. Basically, it represents the capacity of the business to produce future cash flows (from the fifth year onward if the horizon of analytic forecasts is 5 years). This component, using the DCF method, sometimes represents the main body of the business valuation. In some cases we can find ourselves faced with negative cash flows in the period of the analytic forecasts and a positive overall business value thanks to the contribution of the terminal value. In this case, typical of businesses in their startup phase, the whole value would depend on the terminal value.

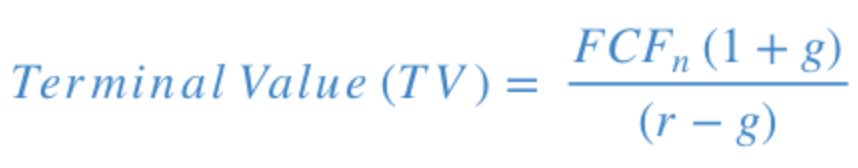

The terminal value is obtained by capitalizing the average earnings or cash flow of the business’s last year to an expected rate of earnings, adjusted for the growth rate of the considered flows. In formula:

Where FCF is the cash flow of the final year of the period of analytic forecasting, which multiplied by a rate of growth g, permits us to obtain the cash flow at year n+1. As previously stated, instead of cash flow we can use the gross margin (or Ebitda).

The numerator becomes capitalized to a expected rate of return (r) reduced by the rate of growth of the considered flows (g). In this case, the subtraction determines an increase of the terminal value, in that we hypothesize that the earnings flow grows from year to year at a rate of growth g.

The terminal value calculated in this way should then be discounted to the expected rate of return.

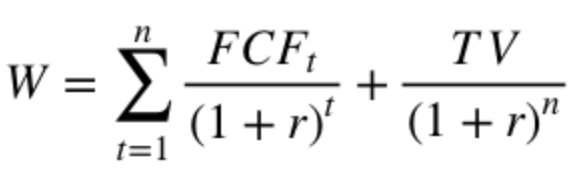

Below is the complete formula of the two-stage method of valuation according to the DCF approach:

n = period of analytical forecasts

II. Venture Capital Method

The Venture Capital Method for valuation of a startup is generally used in the early phases of the life of a startup by venture capitalists, who are often the investor-protagonists of this stage. The two fundamental variables taken into consideration with this valuation approach are:

– the expected ROI;

– the Exit (Terminal Value).

This comes about because when investors acquire shares of a startup, they do this because they expect, at the moment of their exit from the investment, to have obtained an economic return, that is, an increase in the capital invested. Using the Venture Capital method, therefore, an estimate of the startup’s value after 8 to 10 years is carried out (precisely, its Terminal Value), which is compared to the expected ROI, to obtain the post-money value. The Terminal or Exit Value can be calculated in various ways, for example by hypothesizing the expected profits and applying to these the price/earning multiple of the market. The formula is defined in this way: Post-money valuation = Terminal Value / Expected ROI. Subtracting the amount of the investment from the post-money valuation, we obtain the pre-money value. This method is useful to investors for estimating the advisability of the investment compared to the expected economic return.

III: First Chicago Method

The First Chicago Method is an approach to valuing startups that takes into consideration various reference scenarios, for which predicting the future is very complex. This method is considered a re-elaboration of traditional methods, in that it uses the Discounted Cash Flower or the Venture Capital method.

In this case three different scenarios can be defined: one positive, one neutral, and one negative. For example, one can predict an increase in sales in the positive scenario, or a decrease in the negative one. In each scenario, the value of the startup is calculated using the DCF method, or alternatively, the Venture Capital method, or even others, to then multiply the startup value in the various scenarios, considering the probability that such scenarios will occur. The overall startup value with the First Chicago method will be nothing other than the weighted average of the startup value in three different scenarios, with weights that are based on the probability that a determined scenario will occur.

Many investors who enter into the early stage phase of the startup trust this valuation method, because it allows anticipation of possible future scenarios – both positive and negative – for the evolution of the startup.

What we can do for you

The studio is able to accompany startups in all phases of project development: from drawing up the business plan to estimating the business’s value, in order to determine a value to present as the point of departure for a future negotiation of shares with investors or financiers.

The studio partners with a business incubator and accelerator, which allows interfacing with a broad network both of subjects potentially interested in investing in new startups, and in businesses with which to develop synergetic projects.

We offer, besides, consultancy in the search for financial resources, fundamental above all in the early phases of development of the entrepreneurial idea.